Why Financial Performance Improvement Matters

In the competitive business landscape, improving financial performance is crucial for profitability and sustainability. Effective financial strategies ensure robust cost management and enhance overall financial health.

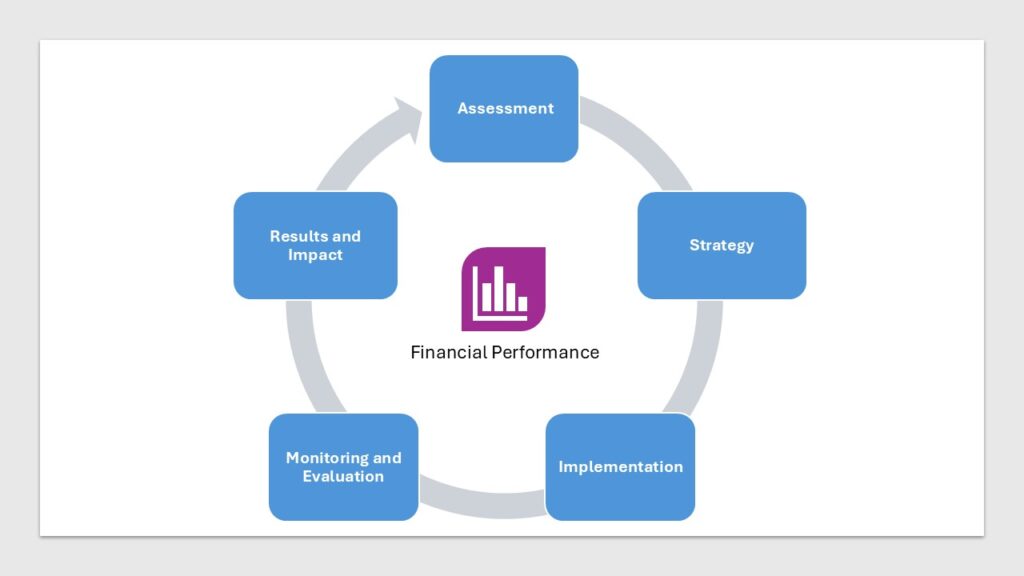

Our Proven Process for Financial Performance Improvement

Step 1: Financial Assessment

Goal: Gain a comprehensive understanding of the current financial status.

Activities: Conduct a detailed financial analysis, review financial statements, and identify key financial metrics.

Outcome: A clear picture of the financial strengths and weaknesses of the business.

Step 2: Goal Setting

Goal: Define clear, measurable financial goals aligned with the company’s strategic objectives.

Activities: Set short-term and long-term financial targets, determine KPIs, and establish benchmarks for success.

Outcome: Specific, measurable, achievable, relevant, and time-bound (SMART) financial goals that guide strategic direction.

Step 3: Strategy Development

Goal: Formulate strategies to achieve financial goals.

Activities: Develop actionable financial plans, optimize budgeting and forecasting processes, and identify cost-saving opportunities.

Outcome: A detailed financial strategy that outlines steps to improve profitability and cost management.

Step 4: Implementation

Goal: Execute financial strategies effectively.

Activities: Assign responsibilities, deploy resources, and initiate projects according to the financial plan. Ensure continuous monitoring and adjustment of financial activities.

Outcome: Effective execution of financial initiatives leading to improved profitability and cost management.

Step 5: Monitoring and Evaluation

Goal: Track the progress of financial initiatives and measure their impact.

Activities: Use KPIs to monitor financial performance, conduct regular financial reviews, and gather feedback from stakeholders. Adjust strategies as necessary based on performance data.

Outcome: Data-driven insights that guide ongoing financial decisions and adjustments.

Step 6: Continuous Improvement

Goal: Ensure continuous improvement in financial performance.

Activities: Regularly review financial goals, update plans based on new data and market conditions, and foster a culture of continuous improvement.

Outcome: A dynamic financial strategy that evolves with the business and market environment.

The Benefits of Financial Performance Improvement

- Enhanced Profitability: Drives significant improvements in profitability through effective cost management.

- Financial Stability: Ensures robust financial health and long-term sustainability.

- Informed Decision-Making: Provides a clear roadmap for strategic financial decisions and adjustments.

Success Story: Restoring Financial Performance and Profitability

Our client experienced an unexpected erosion in their Cost of Goods Sold (COGS) and a consequent decline in gross margins. Despite recently acquiring new business that should have bolstered their profitability, the financial metrics told a different story. Seeking clarity and resolution, they turned to JAYCE Consulting for a comprehensive review of their financial performance.

Upon our thorough analysis, we identified critical discrepancies in material pricing and quoted press sizes, along with misrepresented overhead rates. These issues were causing the financial performance to deviate from expected outcomes. By pinpointing these inaccuracies, we were able to correct the Bill of Materials and realign the financial projections with reality.

As a result, we successfully restored the profitability of this business segment, ensuring that the client’s financial goals were met. Our intervention not only stabilized the company’s margins but also reinforced the accuracy and reliability of their financial processes. This success underscored JAYCE Consulting’s commitment to delivering precise and impactful financial solutions.

Ready to Boost Your Financial Health?